History

Content on this page

The main pillars in Folketrygdfondets history.

1967-1991

1967-1979

Folketrygdfondet was established in 1967 to manage the surpluses in the National Insurance scheme. During the first twelve years, NOK 11.8 billion was transferred to the fund, but as social security benefits increased beyond the 70s, there was no surplus to deposit into the fund. 1979 was the last year with capital deposits. The capital was investet in fixed income and bank deposits, primarily in Norwegian government bonds.

1979-1990

The management of Folketrygdfondet was initially divided into five regions with separate boards. In 1990 the regional boards were wound up, and Folketrygdfondet was organised directly under the Ministry of Finance.

1991

The fund gaisn access to invest in publicly listed Norwegian stocks.

2001-2006

2006

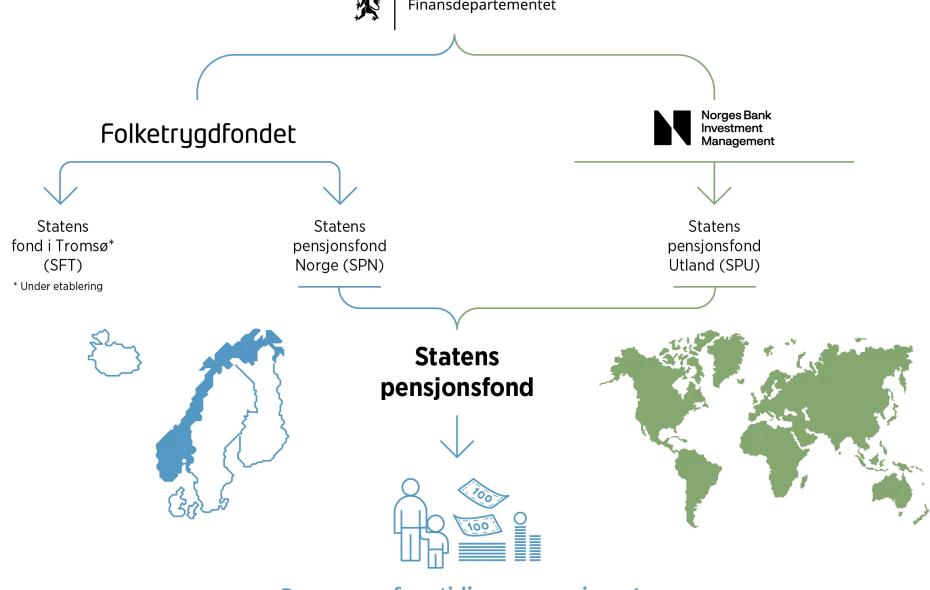

The Government Pension Fund is established as a superstructure encompassing the Government Pension Fund Global (the "Oil Fund") and the Government Pension Fund Norway. The name Folketrygdfondet from now on refers to the organisation managing the Government Pension Fund Norway.

2007

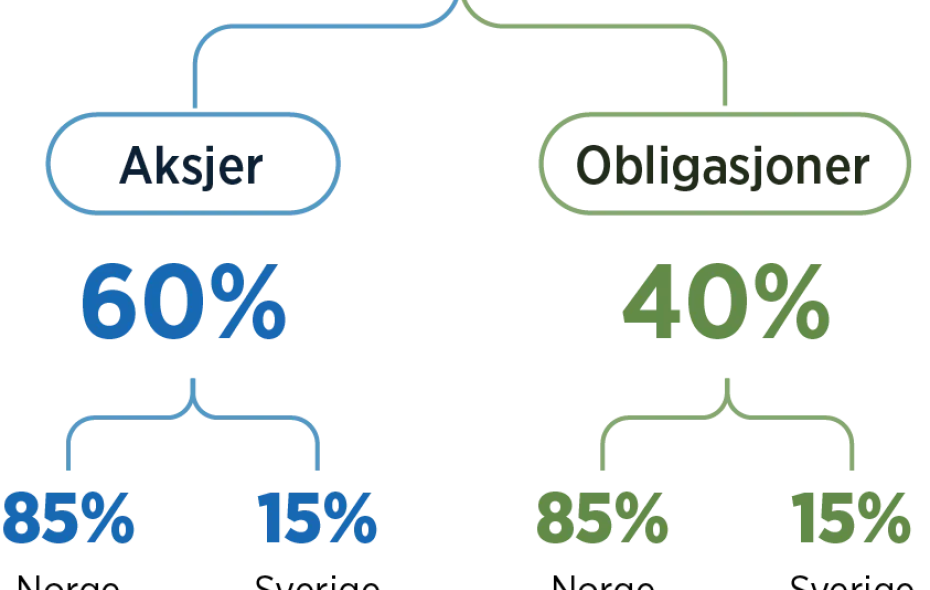

Folketrygdfondet receives a new mandate for the management of the Government Pension Fund Norway.

2008

Folketrygdfondet is transformed to a company by special statute under the Ministry of Finance. This marks a clear delineation between the capital (Government Pension Fund Norway) and the manager of this capital (Folketrygdfondet).

2009-2024

2009-2014

The Government Bond Fund was established as a measure during the financial crisis with Folketrygdfondet as the manager. The purpose was to contribute to increased liquidity and access to capital in the Norwegian credit bond market. At the start, 50 billion NOK was allocated to the fund. The funds were placed on market terms, and was invested together with other investors in each loan. The capital was placed in interest-bearing securities issued by companies domiciled in Norway.

In 2013, a liquidation plan for the Government Bond Fund was presented, as the mandate requires, and it was liquidated on September 19, 2014.

2020- 2024

The Government Bond Fund is re-established as a measure during the coronavirus pandemic with Folketrygdfondet as the manager. A liquidation plan was adopted in the fall of 2022 with the goal of liquidation by the end of 2025.

The fund was terminated in December 2024, within the adopted plan.

2024

The Norwegian Parliament passes the law on the Government Fund Tromsø. The fund receives an initial investment framework of NOK 15 billion and the mandate to invest based on a market-weighted index of smaller publicly listed Nordic companies.

2024

2024

The fund's holdings on the Oslo Stock Exchange have grown over time through returns and reinvestment of dividends. This results in an increased risk of breaching the mandate that limits ownership in a single company to 15 percent.

As a solution to the challenge of high ownership stakes in the Norwegian market, the Government proposes annual withdrawals from the fund. A simple, mechanical rule of 3 percent is adopted, effective from the state budget in 2025.