Ny analyse bekrefter at Folketrygdfondet har svært lave kostnader

Den årlige rapporten fra det kanadiske konsulentfirmaet CEM Benchmarking Inc. (CEM) viser at Folketrygdfondets forvaltningskostnader knyttet til Statens pensjonsfond Norge (SPN) er lavere enn samtlige sammenlignbare fond globalt.

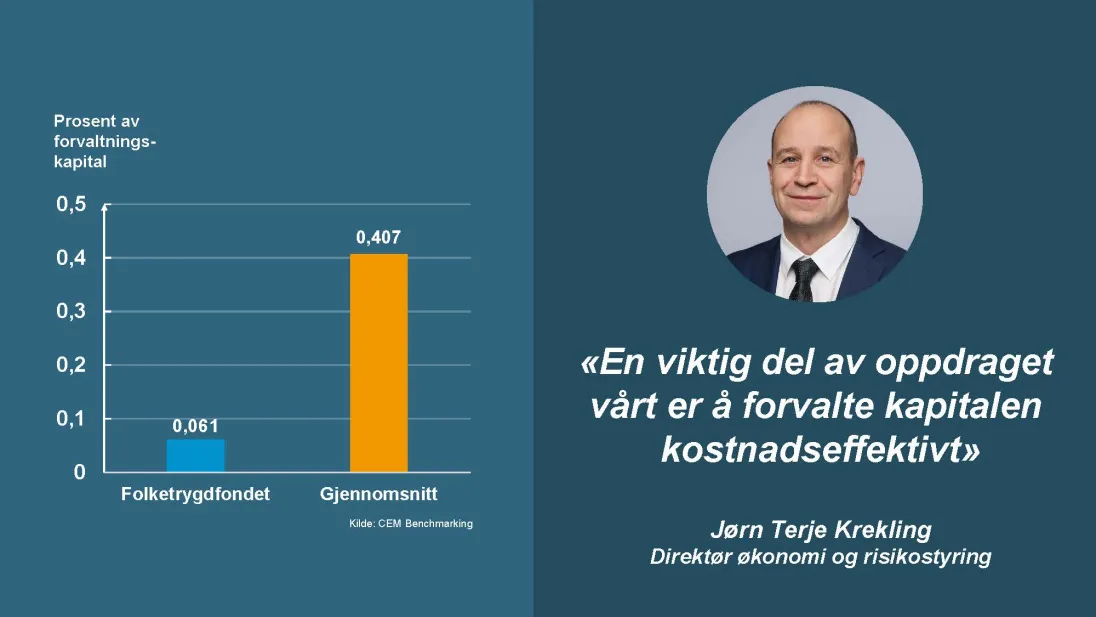

I perioden 2012 til 2022 har kostnadene også falt fra 0,094 til 0,061 prosent av gjennomsnittlig forvaltningskapital.

- Vårt mål er å oppnå høyest mulig avkastning etter kostnader på lang sikt, derfor er en viktig del av oppdraget vårt å forvalte kapitalen kostnadseffektivt, sier direktør for økonomi og risikostyring, Jørn Terje Krekling. Dette bekreftes av den årlige rapporten som utarbeides for Finansdepartementet.

Folketrygdfondets forvaltningskostnader på 0,061 prosent (0,059 prosent i 2021) var lavest av samtlige i gruppen av sammenlignbare fond, der mediankostnaden var 0,407 prosent (0,382 prosent i 2021). Mediankostnaden var med andre ord over seks ganger høyere enn Folketrygdfondets. Det skal nevnes at fondene SPN blir sammenlignet med har en lavere aksje- og obligasjonsandel, og mer unoterte aktiva som historisk har vært forbundet med høyere forvaltningskostnader.

- Mye av årsaken til de lave kostnadene er at vi forvalter hele SPN selv, uten bruk av eksterne forvaltere. Dessuten skyldes det kostnadseffektiv forvaltning hos oss. Selv om kostnadene steg marginalt i 2022 viser rapporten at mediankostnaden blant de sammenlignbare fondene økte betydelig mer, sier Krekling.

For å få et bedre bilde av hvor kostnadseffektive Folketrygdfondet er, har CEM laget en kostnadsreferanse som viser hva de sammenlignbare fondene hadde hatt i kostnader dersom de var sammensatt av aksjer og obligasjoner på samme måte som SPN.

Også i denne sammenligningen kommer Folketrygdfondet svært godt ut med kostnader som er under halvparten av kostnadsreferansen (0,079 prosentpoeng lavere).

Du kan lese CEM-rapporten for 2022 her